- Gold weekly forecast turns bullish as Fed Chair hinted at a rate cut in September.

- Easing tensions in Ukraine could cap the gains in gold.

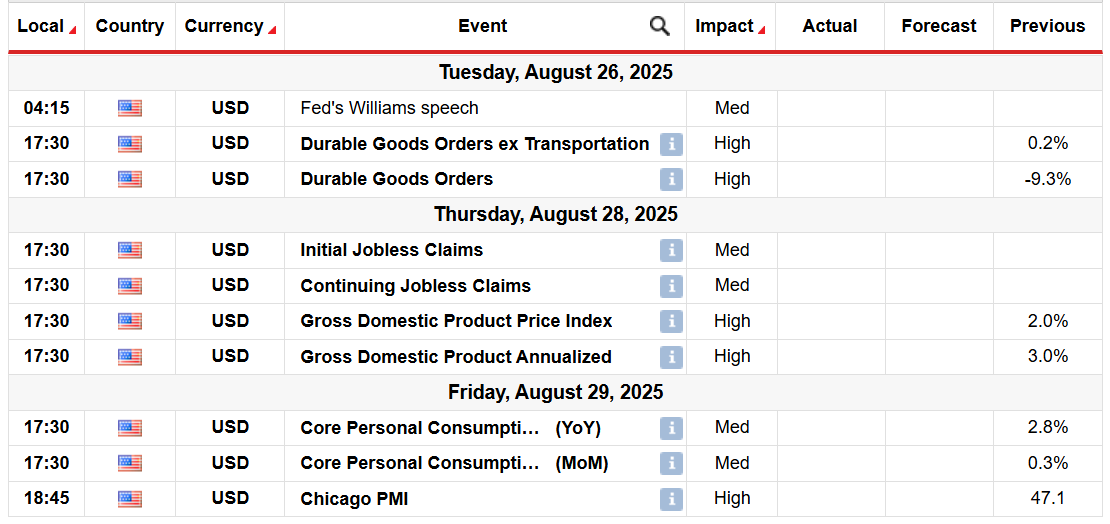

- Traders eye the US Core PCE and US GDP q/q data due next week for more impetus.

Gold ended the previous week on an optimistic note, rising above the $3,370 level, following the Fed Chair Powell’s statements at Jackson Hole that triggered the dollar downside and yields. Powell indicated a change of course toward adaptable inflation as the higher interest rates are weighing on the labor markets. This weekend recovery will put focus on another data-intensive week that can determine whether gold continues its recovery, or is once again under pressure.

–Are you interested in learning more about crypto robots? Check our detailed guide-

The motivation to invest in gold will mainly be US macro-economic releases, which will be testing the Fed policy outlook. On Tuesday, Durable Goods Orders data is due, which will indicate business activities. Following a sharp 9.3% plunge in June, markets are anticipating a further 4.0% decrease. This could also be a mixed bag as a lower print would drag on the dollar and benefit gold, whereas an outperformance would push up Treasury yields and halt gold bulls.

The most important release of the week is the July Core Personal Consumption Expenditures (PCE) Price Index due on Friday. Inflation remains sticky, and any upside surprise would prompt a reassessment of future rate cuts. Stronger-than-anticipated PCE would drive Treasury yields up and gold down. A weaker number, on the other hand, would support bets on the dovish Fed and could see another upside swing in XAU/USD.

On Thursday, markets will see the second estimate of Q2 GDP growth. First reading increase was healthy with 3% annualized growth. Downward adjustment would reaffirm the idea that the US economy is slowing down. This would augment gold as traders seek a haven during a period of economic downturn.

Geopolitical tensions calmed down further following the easing of tensions in Ukraine, which capped gold demand last week. According to the CME FedWatch Tool, the probability of a 25 bps reduction in September is now 90%. The traders anticipate consistent easing into the close of the year. Such weighted dovishness, however, also constrains the ability of the dollar to weaken further unless future data clearly warrants against the move.

Gold weekly technical forecast: Bulls to challenge $3,400

The daily chart shows a close above the confluence of 20- and 50-day MAs near $3,350. However, the price is still playing within the range, well below the upper boundary of $3,440. The 100-day MA continues to support the bulls. The next key resistance for gold lies at $3,400.

–Are you interested in learning more about buying Dogecoin? Check our detailed guide-

On the flip side, breaking the $3,300 support at 100-day MA could open the path for losses towards $3,260 support level ahead of the next support at $3,200.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.